INDIAN ECONOMY

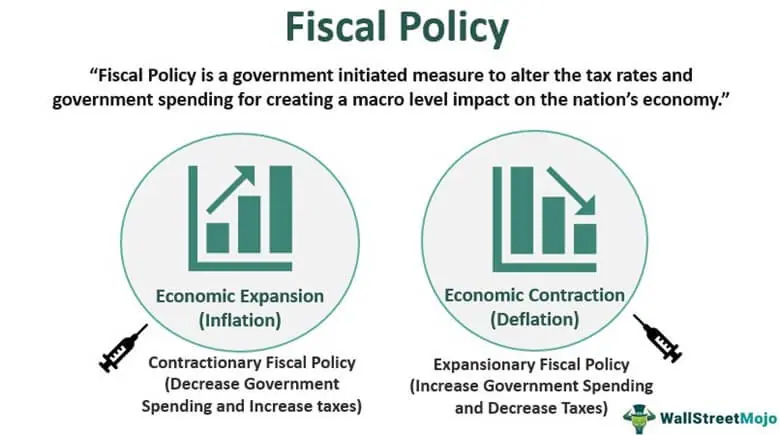

Introduction

Economics is a social science that deals with the production, consumption, and distribution of goods and services, and the transfer of wealth. The term ‘Economics’ is derived from the Greek words OIKOS (“household”) and NEMEIN (“management and dispensation”). Understanding “What is Economics?” is very important for UPSC/IAS Exam 2023 to understand further concepts in a holistic manner. In this article, we will look at the meaning of economics and how it has changed over time.

What exactly is Economics?

- Economics is the study of scarcity, resource utilisation, and response to incentives, or the study of decision-making.

- Economics is a vast subject and its definition and meaning have undergone changes over a period of time.

- Aristotle, the Greek Philosopher has termed Economics as a science of ‘household management.’

- There are two branches of economics: microeconomics and macroeconomics.

Meaning of Economics

Due to its vastness, the meaning of economics has changed over the course of time. Let us see the evolution of the meaning of economics from the late eighteenth century.

Science of Wealth

- The late eighteenth-century classical thinkers viewed that economics deals with the phenomenon of wealth.

- This includes the nature and causes of wealth and the creation of wealth by individuals and nations.

Science of Welfare

- In the early nineteenth century, scholars felt that economics should address the welfare of society as only wealth divided the society into rich and poor.

- Welfare is both quantitative and qualitative. The quantitative aspects involve consumption of goods and services, increase in per capita income, etc.

Science of Scarcity and Choice

- The welfare definition only explains the material goods aspects of welfare and not the non-material services aspects.

- Since resources available in society to individuals are scarce, we try to achieve our goals by alternatively using resources and using them appropriately.

- For instance, consider an example where cloth and wheat are produced with fixed limited resources.

- When the demand for Wheat is increased either we ignore the demand and produce the same quantities of cloth and wheat or allocate more resources to wheat production by cutting from cloth production to meet the demand.

Science of Growth and Development

- In the twentieth century, the role of government to ensure the growth and development of the entire economy gained momentum.

- Therefore economics was no longer limited to individual decision-making and use of resources but included production and consumption of commodities over time.

- It is well acknowledged that in order for an individual to be able to fulfil his or her desires, the entire economy must grow and appropriate mechanisms must be found to transfer the advantages of growth among individual residents.

- As a result, the economy’s performance is critical in terms of resource utilisation, production, and distribution of products and services.

- The economy must distribute its resources across numerous alternative activities, assure their efficient utilisation, and figure out how to grow them for future economic development.

Science of Sustainable Development

- In the late twentieth century, economists talked about the welfare of future generations and the protection of the environment.

- To achieve high growth and development the natural environment is exploited.

- Increased consumption leads to wastage and it should be noted that many minerals are available in limited quantities which we may not leave behind for future generations.

- It is our moral obligation to use the limited resources available wisely and efficiently in order to secure the well-being of future generations.

- Nobel Laureate Prof. Samuelson has spelt out Economics as follows: “Economics is the study of how men and society choose, with or without the use of money, to employ scarce productive resources which could have alternative uses, to produce various commodities over time, and distribute them for consumption now and in the future among various people and groups of society”.

Introduction

The law of demand and supply is an economic law that says that the price of a commodity is determined by the relationship between demand and supply. In general, as prices rise, people are willing to supply more and demand less, and vice versa when prices fall.

It indicates an individual’s level of interest in a particular good or service. Most economic principles are supported by the law of demand and supply. The topic “Law of Demand and Supply” is one of the important concepts in the UPSC/IAS 2024/25 Economy syllabus which is discussed in this article in detail.

Law of Demand & Supply – Concept

- According to the law of demand, as prices rise, buyers demand less of an economic good.

- According to the law of supply, at higher prices, sellers will supply more of an economic good.

- These two laws interact to determine the actual market prices and volume of goods traded on a market.

- Several independent factors can influence the shape of market supply and demand, influencing both the prices and quantities observed in markets.

Law of Demand

- According to the law of demand, if all other factors remain constant, the higher the price of a good, the fewer people will demand that good.

- Buyers purchase less of a good at a higher price because as the price of good rises, so does the opportunity cost of purchasing that good.

- As a result, people will naturally avoid purchasing a product that requires them to forego the consumption of something else that they value more.

- The graph below depicts the curve’s downward slope.

A, B, and C are points on the demand curve. Each point (A, B, C) represents the quantity demanded (Q) at a given price (P). For example, at point A, the quantity demanded is low (Q1) and the price is high (P1). The demand relationship curve illustrates the negative relationship between price and quantity demanded. Consumers demand less quantity of goods at higher prices, and more at lower prices.

Exceptions to Law of Demand

|

Law of Supply

- According to the law of supply, price variations for a product are linked to the quantity supplied.

- The relationship between the law of supply and demand is direct rather than inverse.

- The quantity offered increases as the price rises. Generally speaking, fewer supply results from lower prices.

- Prices that are higher encourage producers to produce more of the good or commodity, given that their costs aren’t rising as quickly.

- A cost squeeze brought on by lower pricing restricts supply. Supply slopes are as a result upwardly sloping from left to right.

- Similar to how supply restrictions affect demand, supply shocks can result in a disproportionate price change for a commodity necessary for production.

- The chart below depicts the law of supply using an upward sloping supply curve.

A, B, and C are points on the supply curve. Every point on the curve represents a direct relationship between quantity supplied (Q) and price (P). So, at point A, the quantity supplied is Q1, and the price is P1, and so on.

Determinants of Demand and Supply

Demand Determinants

While price is a primary driver of demand, several other factors influence consumer behavior:

- Income: Changes in income levels impact consumers’ ability to purchase goods.

- Tastes and Preferences: Shifts in consumer preferences can lead to changes in demand.

- Price of Related Goods: The demand for one good can be influenced by changes in the prices of related goods (substitutes or complements).

- Population and Demographics: Changes in population and demographics affect overall demand.

Supply Determinants

Supply, too, is influenced by various factors beyond price:

- Production Costs: Changes in input costs like labor, raw materials, and technology impact production decisions.

- Technology and Innovation: Advances in technology can lead to increased production efficiency.

- Number of Producers: An increase in the number of producers can influence total supply.

- Government Policies: Regulations and taxes can impact the cost of production and, consequently, supply.

Factors Affecting Supply and Demand

Factors Affecting Supply

- When product prices are below manufacturing costs in businesses where suppliers are unwilling to lose money, supply tends to decline until it reaches zero.

- Price elasticity will also be influenced by the quantity of sellers, their combined production capability, how readily it can be raised or dropped, and the competitive dynamics of the market.

- Taxes and rules may also be important.

Factors Affecting Demand

- One of the key factors affecting demand is consumer income, preferences, and readiness to switch from one product to another.

- Since the marginal utility of goods decreases as the quantity owned rises, consumer choices will depend in part on a product’s market penetration.

Demand Elasticity

Demand elasticity or price elasticity of demand refers to the degree to which rising prices translate into falling demand. For example,

- The demand elasticity of corn is one if a 50% increase in corn prices causes a 50% decrease in corn demand.

- The demand elasticity is 0.2 if a 50% increase in corn prices only reduces the quantity demanded by 10%.

- For products with more elastic demand, the demand curve is shallower (closer to horizontal), and for products with less elastic demand, the demand curve is steeper (closer to vertical).

- A new demand curve must be drawn if a factor other than price or quantity changes.

- Assume that the population of a region explodes, increasing the number of mouths to feed. In this scenario, even if the price remains constant, more corn will be demanded, causing the curve in the graph below to shift to the right (D2).

- Other factors, such as changes in consumer preferences, can also cause the demand curve to shift.

- If cultural shifts cause the market to prefer quinoa over corn, the demand curve will shift to the left (D3).

- If consumer income falls, reducing their ability to purchase corn, demand will shift to the left (D3).

- If the price of a substitute increases from the consumer’s point of view, consumers will buy corn instead, and demand will shift right (D2).

- If the price of a supplement, such as charcoal for grilling corn, rises, demand will shift to the left (D3).

- If the future price of corn is higher than the current price, demand will temporarily shift to the right (D2), because consumers will be more inclined to buy now before the price rises.

Equilibrium

- The equilibrium price, also known as a market-clearing price, is the price at which the producer can sell all of the units he wants to produce and the buyer can buy all of the units he wants to buy.

- It is easy to see how an upward-sloping supply curve and a downward-sloping demand curve will intersect at some point.

- At this point, the market price is sufficient to entice suppliers to bring to market the same quantity of goods that consumers are willing to pay for at that price.

- Supply and demand are in equilibrium.

- The precise price and amount at which this occurs are determined by the shape and position of the respective supply and demand curves, both of which are influenced by a variety of factors.

Examples of Law of Supply

- When college students realize that computer engineering jobs pay more than English professor jobs, the supply of computer engineering majors will increase.

- When consumers begin to pay more for cupcakes than for donuts, bakeries will increase their cupcake output while decreasing their donut output in order to increase their profits.

- When your employer pays time and a half for overtime, you increase the number of hours you are willing to work.

Significance

Law of Demand and Supply – Significance

- The Law of Demand and Supply is critical because it assists investors, entrepreneurs, and economists in understanding and forecasting market conditions.

- For example, a company launching a new product may purposefully attempt to raise the price of the product by increasing consumer demand through advertising.

- At the same time, they may try to raise their prices even further by deliberately limiting the number of units they sell in order to reduce supply.

- In this scenario, supply would be reduced while demand would be increased, resulting in a higher price.

- Together with the Law of Supply, the Law of Demand helps us understand why things are priced the way they are and to identify opportunities to buy perceived under-priced (or sell perceived overpriced) products, assets, or securities.

- For example, a company may increase output in response to rising prices caused by a surge in demand.

Law of Demand and Supply – Applications

Price Determination and Market Equilibrium

- The interaction between demand and supply determines the equilibrium price and quantity in a market.

- Equilibrium is reached when the quantity demanded equals the quantity supplied, ensuring that no excess demand or supply exists.

Policy Formulation and Predictive Insights

- The law of demand and supply aids policymakers in understanding the impact of various policies on markets.

- It also allows for predictions about the effects of changes in demand and supply on prices and quantities.

Real-World Scenarios

- From basic commodities to luxury goods, the law of demand and supply manifests in various real-world scenarios.

- Its application is visible in determining everything from the price of oil to the availability of electronics.

Law of Demand and Supply – Drawbacks

- Unemployment is caused by a lack of demand for goods.

- During the Great Depression, factories sat idle and workers were laid off because there was insufficient demand for those products.

- In the case of Giffen goods, when the price of a Giffen good rises, demand rises, and demand falls when the price falls. For example, staple food, similar to bread or rice, for which there is no viable substitute. The demand for these goods is increasing, which contradicts demand laws.

- Prestigious Goods: Demand for goods of prestige like gold may not decrease even if there is a rise in price. They are purchased and consumed because of their high prices.

- Hobbies: The law of demand is not applicable in the case of goods of hobbies like ticket collection, and collection of historical and archaeological materials. The things are collected even by paying more and more price.

- Addiction: In the case of goods and addiction like alcohol, tobacco, drugs, etc the demand does not decrease even if there is an increase in price. Instead of the operation of the law of demand, consumers purchase more units even if there is a rise in price.

- Future Prices: When the price of rice rises and the seller expects the price to rise further in the future, supply will decrease because the seller will be induced to withhold supplies in order to sell later and earn larger profits.

- Agricultural Output: The law of supply may not apply in the case of agricultural commodities because production cannot be increased all at once in the event of a price increase.

- Subsistence Farmers: The law of supply may not apply in underdeveloped countries where agriculture is dominated by subsistence farmers.

- Factors Other Than Price Are Not Constant: The law of supply is stated with the assumption that factors other than the commodity’s price remain constant.

Conclusion

The law of supply and demand thus combines two major economic theories that explain how variations in the price of a resource, good, or service affect its supply and demand. In practice, the market equilibrium price is determined by people’s willingness to supply and demand a good, or the price at which the quantity of the good that people are willing to supply equals the quantity that people demand.

Mains Questions

Q. Define the Law of Demand and Supply. Also enumerate the drawbacks of the Law of Demand? (150 Words) 15 Marks

Introduction

Elasticity of demand is an important variation on the concept of demand. Demand can be classified as elastic, inelastic or unitary.

An elastic demand is one in which the change in quantity demanded due to a change in price is large. An inelastic demand is one in which the change in quantity demanded due to a change in price is small.

Unitary Elasticity

If the elasticity coefficient is equal to one, demand is unitarily elastic. For example, a 10% quantity change divided by a 10% price change is one. This means that a 1% change in quantity occurs for every 1% change in price.

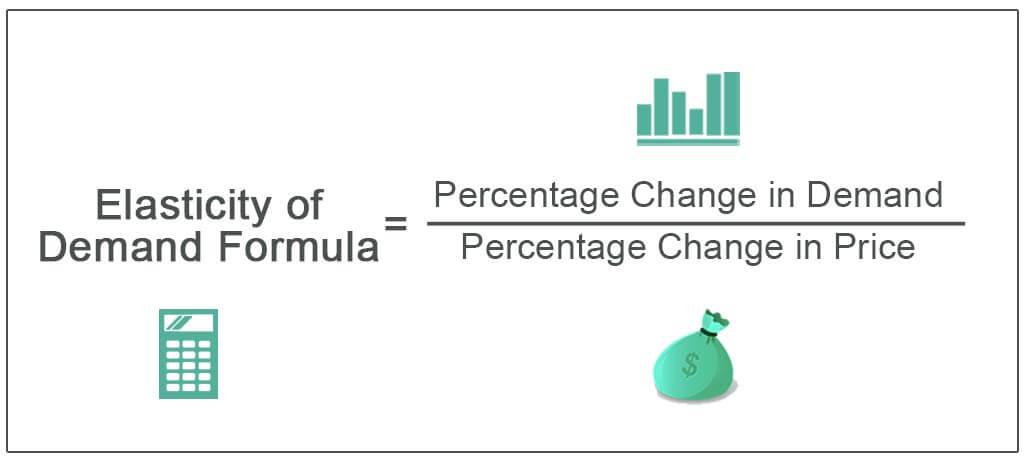

Elasticity of Demand is the percentage change in quantity demanded divided by the percentage change in one of the variables that affect demand. Price elasticity of demand measures how much a product’s consumption changes in response to price changes.

What is Elasticity of Demand?

- An elastic demand is one where there is a significant shift in the quantity demanded as a result of a price change.

- The elasticity of demand describes how sensitive a good’s demand is to changes in other economic variables like prices and consumer benefits.

- Higher demand elasticity for an economic variable indicates that the customers are more conscious of changes in this variable.

Elasticity

|

Elasticity of Demand – Example

- A product is deemed elastic if the amount wanted or purchased fluctuates more than the price does (for instance, the price increases by 5% while the demand decreases by 10%).

- Consumer durables are an example of a product with elastic demand.

- Like a washing machine or an automobile, these are products that are rarely bought and can be postponed if the price goes up.

- For instance, lowering the price of cars has been a very effective way to increase sales of cars.

Types of Elasticity of Demand

- Price elasticity of demand

- Cross elasticity of demand

- Income elasticity of demand

- Advertisement elasticity of demand

Price Elasticity of Demand (PED)

- Price Elasticity of Demand measures the responsiveness of quantity demanded to changes in price. It can be classified into three categories:

- Elastic Demand (E > 1): A relatively small price change leads to a proportionally larger change in quantity demanded.

- Unitary Elastic Demand (E = 1): A percentage change in price results in an equal percentage change in quantity demanded.

- Inelastic Demand (E < 1): Quantity demanded changes proportionally less than the price change.

- The percentage change in the quantity required divided by the percentage change in price is known as price elasticity of demand.

Measurement of Price Elasticity of Demand The price elasticity of demand can be measured in three different ways.

|

Cross Elasticity of Demand (XED)

- The responsiveness to a change in the pricing of related goods is referred to as cross elasticity of demand.

- It is defined as the ability to respond to changes in commodity X demand in response to a change in commodity Y price.

- Positive XED: Substitute goods have a positive value, indicating that an increase in the price of one leads to an increase in demand for the other.

- Negative XED: Complementary goods have a negative value, signifying that an increase in the price of one decreases demand for the other.

Income Elasticity of Demand (YED)

- The responsiveness of demand for a commodity to changes in income, with all other factors, held constant, is known as income elasticity of demand.

- Positive YED: Normal goods have a positive value, signifying that an increase in income leads to an increase in demand.

- Negative YED: Inferior goods have a negative value, indicating that an increase in income results in reduced demand.

Advertising Elasticity of Demand (AED)

- Advertising elasticity of demand (AED) is a measure of a market’s sensitivity to changes in advertising saturation.

- Advertising elasticity assesses the effectiveness of an advertising campaign in generating new sales.

- It is calculated by dividing the percentage change in demand by the percentage change in advertising spending.

- A positive advertising elasticity indicates that increasing advertising increases demand for the advertised goods or services.

Factors That Affect Price Elasticity of Demand

Availability of Substitutes

- The price will decrease more and more quickly if a customer may substitute one item for another.

- For instance, if everyone in the world prefers both coffee and tea equally, the demand for coffee will decline if coffee prices rise because people will easily switch to tea.

- This is due to the fact that tea and coffee are seen as good alternatives to one another.

Urgency

- The quantity of demand for a product will decrease in response to price rises the more discretionary the purchase is. In other words, the product demand is more elastic.

- Consider that your existing washing machine is still functional despite being old and out-of-date, but you are thinking about getting a new one.

- If the cost of a new washing machine increases, you can decide against making the purchase right away and instead hold off until the price drops or the old machine malfunctions.

- A product’s demand will decline less as its discretionary property increases. Luxury goods that people purchase because of their brand names are an example of an elastic example.

- Both addictive products and necessary add-on items, like inkjet printer cartridges, are rather inelastic.

- All of these products share the problem of having poor alternatives.

Duration of Price Change

- The duration of the price change is also important. A one-day sale has a different impact on consumer demand than a price change that lasts for a season or a full year.

- To understand the price elasticity of demand and to compare it with other items, temporal sensitivity must be clearly defined.

- Consumers could be willing to put up with a seasonal price shift rather than altering their routines.

Applications of Elasticity of Demand

- Business Strategies: Understanding elasticity helps businesses set optimal prices. For goods with elastic demand, price cuts may lead to higher revenue, while for inelastic goods, higher prices might generate more revenue.

- Taxation and Revenue: Governments consider elasticity when levying taxes. For inelastic goods, higher taxes may lead to increased revenue, while for elastic goods, taxes could lead to reduced consumption and revenue.

- Consumer Behavior Analysis: Elasticity provides insights into how consumers react to price changes, aiding companies in making informed decisions about product launches, pricing adjustments, and marketing strategies.

Conclusion

Understanding Elasticity of Demand provides a lens through which consumer behavior and market dynamics can be interpreted. A change in a commodity’s price has an impact on its demand.

By comparing the percentage price changes with the quantities demanded, we may determine the elasticity of demand or the degree of responsiveness of demand.

Mains Questions

Q. Discuss the importance of measuring the Elasticity of Demand in an Economy? (150 Words) 10 Marks

Introduction

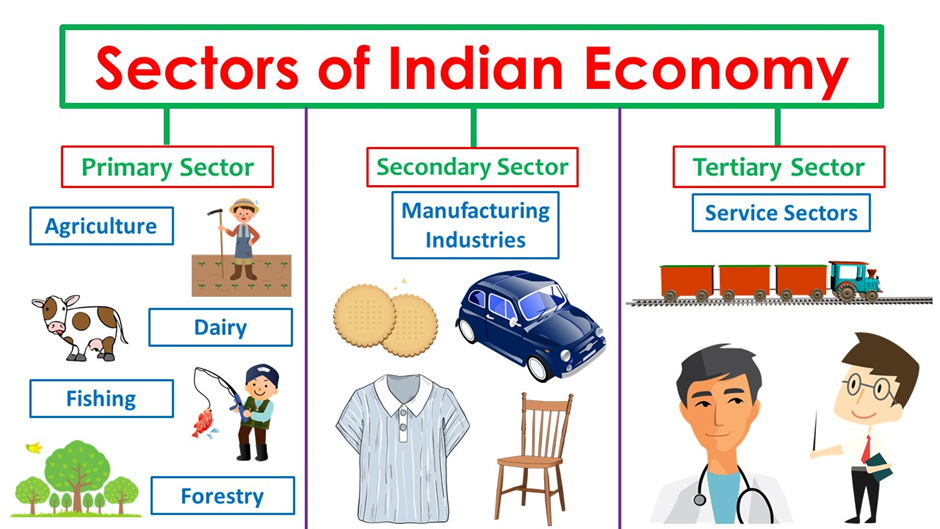

There are three main sectors of the Indian economy: primary sector, secondary sector, and tertiary sector i.e., agriculture, manufacturing, and service sectors.

According to the most recent ‘World Economic League Table 2020’ report, India has surpassed both France and the United Kingdom to become the world’s fifth-largest economy in 2019.

India is expected to be the world’s second-largest economy by 2050. The topic “Sectors of Indian Economy” is one of the important topics in the UPSC/IAS 2023 Economy syllabus which is discussed in this article in detail.

Primary, Secondary, and Tertiary Sectors

What are Sectors in the Economy?

- The Indian economy operates within a diverse framework of sectors, each playing a crucial role in its growth and development.

- These sectors, each with its unique characteristics and contributions, form the backbone of India’s economic landscape.

- On the basis of ownership, labour conditions, and the nature of the operations, the Indian economy can be divided into numerous sectors.

- But the three main sectors of the Indian Economy are: the primary sector, the secondary sector, and the tertiary sector are discussed below.

- During the early stages of civilization, the primary sector accounted for all economic activity.

- People’s demand for other items grew as a result of the surplus food production, resulting in the growth of the secondary sector.

- During the nineteenth century’s industrial revolution, the secondary sector expanded its significance.

- To facilitate industrial activities, a support system was required. Certain industries, such as transportation and finance, were critical in sustaining industrial activity.

Main Sectors in India’s Economy

On the Basis of Activity Nature, the three main sectors of the Indian Economy are the primary sector, the secondary sector, and the tertiary sector.

Primary Sector

- The activities of the primary sector of the economy are carried out by utilising natural resources directly.

- Agriculture, mining, fishing, forestry, dairy, and other industries fall into this category.

- It is thus named because it serves as the foundation for all other sectors.

- About 54.6 percent of the total workforce in the country is still engaged in agricultural and allied sector activities.

- Agriculture, together with fisheries and forestry collectively make up one-third of India’s GDP. The primary sector generates 18.20 percent of the GDP.

- India’s economy has always been based primarily on agriculture. In addition, India is the second-largest producer of groundnuts, wheat, sugar, freshwater fish, and milk in the world.

- It is also known as the Agriculture and Allied Sector since agriculture, dairy, forestry, and fishing provide the majority of the natural items we consume.

- Due to the nature of their profession, people who engage in primary activities are referred to as red-collar employees.

- Underemployment and covert employment are the two main problems this industry is dealing with.

Secondary Sector

- The secondary Sector covers industries that manufacture finished goods from natural materials harvested in the primary sector.

- This sector includes operations such as industrial production, cotton fabric manufacture, sugar cane production, and so on.

- As a result, rather than producing raw materials, it is the sector of a country’s economy that manufactures goods.

- This sector is often known as the industrial sector because it is involved with various types of industries.

- Blue-collar employees are those who engage in secondary activities.

- The contribution of the industrial sector has been constantly declining since 2011-12.

Tertiary Sector/Service Sector

- The Tertiary Sector covers the services provided in the economy and not the goods or tangible items.

- The services sector’s significance in the Indian economy has been steady, with the sector now accounting for over 54 percent of the economy and almost four-fifths of total FDI inflows.

- The activities of this sector contribute to the growth of the primary and secondary sectors.

- Economic activities in the tertiary sector do not produce things on their own, but they do help or assist production.

- The sector includes goods transported by trucks or trains, as well as banking, insurance, and finance.

- It adds value to a product in the same way that the secondary sector does.

- These sector jobs are called white-collar jobs.

Quaternary Sector

Quinary Sector

|

Why did India shift from the primary sector to the services sector and not the secondary sector?

- A country’s normal economic path is from agrarian to industrial to a service economy, but India has jumped ahead of the curve from agrarian to service economy.

- Diversification towards services has been a notable element of India’s recent prosperity, with the services sector accounting for the majority of GDP.

- India has become a prominent services exporter thanks to its success in software and IT-enabled services (ITeS), with its share of global services exports rising from 0.6 percent in 1990 to 3.3 percent in 2013.

- Other factors for the country’s quick expansion in the service industry include well-educated and vast human resources, fluency in English, and the availability of cheap labour.

- On the other hand, low growth in the Secondary sector can be attributed to:

- The license Raj

- Restrictions on foreign investment

- Lack of measures to promote private industry

- Power Deficit

- Stringent Labour laws

- Lack of skilled labour

- Delays in Land Acquisition and environmental Clearances

- Import of cheap manufactured goods etc.

- Despite its low per capita income, India’s percentage of GDP from services is approaching the worldwide norm. However, unlike the global average, the contribution of services to employment was much lower.

- Because the manufacturing sector is labour-intensive, greater emphasis on manufacturing through initiatives such as ‘Make in India’ would help to remedy this anomaly and increase employment in line with GDP growth.

Other Sectors in India’s Economy

1) On the Basis of Work Condition

Organised Sector

- In this industry, employment terms are set and consistent, and employees are guaranteed work and social security.

- It can also be characterised as a sector that is registered with the government and is subject to a variety of laws. The organised sector includes schools and hospitals.

- Workers in the organised sector have more job security.

- They are only required to work a set amount of hours. If they work longer hours, the company must compensate them with overtime pay.

Unorganised Sector

- A home-based worker, a self-employed worker, or a wage worker in the unorganised sector is considered an unorganised worker, as is a worker in the organised sector who is not covered by any of the welfare schemes listed in Schedule II of the Unorganized Workers Social Security Act, 2008.

- Due to the transient and seasonal nature of employment and the dispersed placement of businesses, wage-paid labour in this sector is typically non-unionized.

- Low wages, insecure and irregular employment, and a lack of protection from legislation or trade unions characterise this industry.

- The unorganised industry relies primarily on labour-intensive and locally developed technology.

- Workers in the unorganised sector are so dispersed that the legislation’s execution is woefully inadequate and ineffectual. In this industry, there are few unions to function as watchdogs.

- However, as compared to the organised sector, the unorganised sector makes a significant contribution to national income.

- It contributes more than 60% of national income, whereas the organised sector contributes about half of that, depending on the industry.

2) On the Basis of Asset Ownership

Public Sector

- The government owns the majority of the assets in the sector, and it is the segment of the economy responsible for providing various governmental services.

- The public sector does not exist solely to make money.

- Governments raise funds through taxes and other means to cover the costs of the services they provide.

Private Sector

- Asset ownership and service delivery are in the hands of private individuals or organisations in the private sector.

- It is also known as the citizen sector, and it is administered by private persons or groups, usually for profit, and is not governed but regulated by the government.

- The private sector’s activities are guided by the desire to make money. We must pay money to these people and companies in order to obtain such services.

Conclusion

The sectors of the Indian economy, interwoven like threads in a tapestry, collectively contribute to the nation’s progress. The primary sector anchors livelihoods, the secondary sector builds infrastructure, and the tertiary sector catalyzes innovation and services. India’s efforts and initiatives reflect its commitment to balanced growth across sectors, aiming to create a robust and self-reliant economy that benefits all its citizens.

Mains Questions

Q. Discuss as to why the Indian Economy shifted from Primary Sector to Tertiary Sector directly galloping the secondary sector? (150 Words) 10 Marks

Q. Describe the contribution of Primary Sector in the growth trajectory of any country? (150 Words) 10 Marks

Introduction

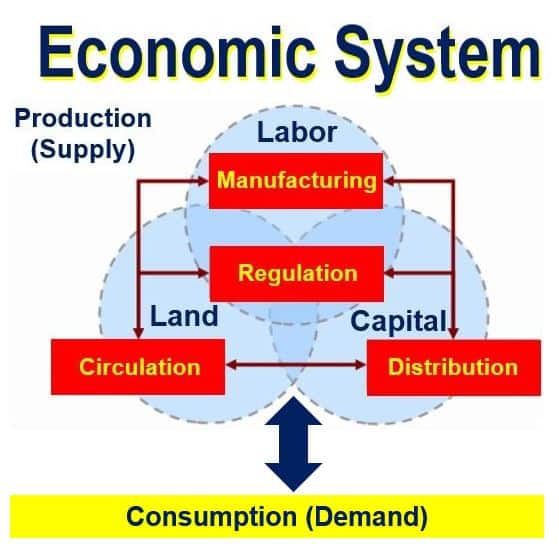

An economic system is a tool that the government uses to plan and distribute accessible services, resources, and commodities across the country. The factors of production, such as land, capital, labour, and physical resources, are regulated by economic systems. A community’s economic system is made up of a variety of institutions, organisations, entities, decision-making mechanisms, and consumption patterns. The topic “Economic System” is one of the important concepts in the UPSC/IAS 2023 Economy syllabus which is discussed in this article in detail.

What exactly is an Economic System?

- An economic system serves as the foundation upon which a nation’s economic activities are structured and organized.

- An economic system or economic order, is a method used by organizations or governments to coordinate and distribute resources, services, and goods throughout a territory or nation.

- It delineates how resources are allocated, goods and services are produced, distributed, and consumed, and the overall economic landscape functions.

- Economic systems combine wealth, labour, physical resources, and business personnel to handle production factors.

Types of Economic Systems

-

Capitalist Economy

- In a capitalist society, items are distributed among individuals based on purchasing power, which is the ability to buy goods and services, rather than on what they want.

- This implies that a person must have sufficient funds to purchase products and services.

- For example, low-cost housing for the poor is desperately needed, yet there will be little demand in the market because the poor lack the purchasing ability to support it.

- As a result, the goods will not be produced and distributed according to market forces.

-

Socialist Economy

- In a socialist economy, the government decides what products should be made to meet society’s needs.

- It is assumed that the government is aware of what is appropriate for the country’s population. As a result, individual purchasers’ passions aren’t given much consideration.

- The government makes decisions about how items are made and how they are disposed of.

- In theory, sharing under socialism is based on what each individual requires rather than what they can afford.

- Because everything is controlled by the government in a socialist regime, there is no separate estate.

-

Mixed Economy

- The characteristics of both the socialist and capitalist economic systems can be found in mixed systems.

- Mixed economic systems are also called dual economic systems for this reason.

- A genuine approach to determining a mixed system, on the other hand, does not exist.

- In some parts of the economy, this term refers to a market system that is subject to rigorous administrative regulation.

Characteristics of an Economic System

All economic systems must address the following four fundamental economic problems:

What goods should be produced?

- Pricing theory serves as the foundation for this important economic issue.

- In this context, the theory of pricing deals with the economic trade-offs between producing capital goods and consumer goods in the face of resource scarcity.

- In this regard, it is crucial to critically assess the demands of society in light of population demographics such as age, sex, occupation, and geography.

How should the goods be produced?

- The main problem of how things should be produced is heavily dependent on the least-expensive method of production that should be used as profitably unique to the economically determined commodities and services to be produced.

- Broadly speaking, labor-intensive and resource-intensive techniques of production are the options.

How should be the produced goods distributed?

- When the final consumers receive the goods, production is said to be finished.

- In order to minimize bottlenecks and clogs in the chain of distribution of economic resources and to maximize consumer happiness, this fundamental problem of how the output will be dispersed aims to determine the best possible medium.

When should be the goods produced?

- Given that the forces of supply and demand are highly dependent on time, seasonal analysis plays a role in consumer satisfaction.

- A thorough examination of time dynamics and seasonal fluctuation in relation to the fulfillment of consumer needs is necessary to solve this fundamental economic challenge.

- It is important to note that the type of economic system might influence the solutions to these fundamental issues.

Major Sectors of Economic System

There are three major economic sectors that make up the overall economy. They are:

- Primary Sector:The primary sector encompasses activities directly tied to the extraction of natural resources from the earth, water, and air. Agriculture, mining, forestry, and fishing stand as core activities within the primary sector, each contributing to a nation’s resource base and livelihoods.

- Secondary Sector:The secondary sector, often known as the industrial sector, plays a vital role in converting raw materials extracted from the primary sector into finished products. This sector encompasses manufacturing, construction, and energy production activities that add value to resources and contribute significantly to a nation’s economic growth.

- Tertiary Sector: Tertiary Sector, also known as the service sector is responsible for providing services to both businesses and final consumers. The tertiary sector offers a diverse array of services, from healthcare and education to finance, entertainment, and tourism.

Differences between Capitalist, Socialist, and Mixed Economies

| Parameters | Capitalist Economy | Socialist Economy | Mixed Economy |

|---|---|---|---|

| Ownership of property | Private ownership | Public ownership | Both private and public ownership |

| Price determination | Prices are determined by the market forces of demand and supply. | The central planning authority determines prices. | The central planning authority, as well as demand and supply, determine prices. |

| Motive of production | Profit motive | Social welfare | In the private sector, profit is the motivating factor, while in the public sector, welfare is the motivating factor. |

| Role of government | No role | Complete role | Full role in the public sector and limited role in the private sector |

| Competition | Exists | No competition | Exists only in the private sector |

| Distribution of income | Very unequal | Quite equal | Considerable inequalities exist |

Conclusion

Economic systems shape the destiny of nations, influencing resource allocation, production, distribution, and ultimately, the quality of life for citizens. India’s mixed economy approach, coupled with strategic efforts, aims to achieve balanced growth and inclusivity.

As nations navigate the complexities of economic systems, the goal remains to foster prosperity while safeguarding the well-being of current and future generations.

Mains Questions

Q. Give an overview of the various types of Economic System? (150 Words) 10 Marks

Introduction

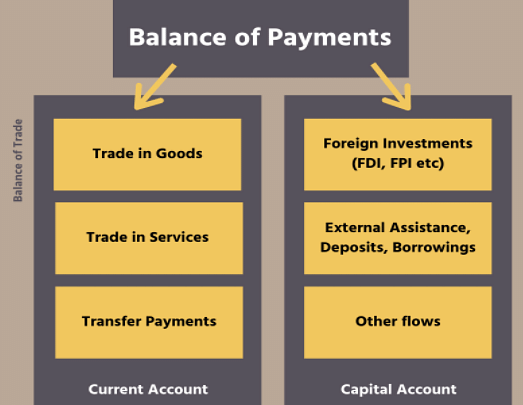

National Income Accounting is a systematic framework used to measure and analyze the economic activity of a country over a specific period. National Income Accounting includes total revenues made by domestic firms, wages given to foreign and domestic workers, and the amount spent on sales and income taxes by corporations and individuals resident in the nation.

The topic “National Income Accounting” is one of the important concepts in the UPSC/IAS 2023 Economy syllabus which is discussed in this article in detail.

What exactly is National Income Accounting?

- National Income Accounting is a systematic framework used to measure and analyze the economic activity of a country over a specific period.

- It involves the comprehensive assessment of the total economic output and income generated within a nation’s borders.

- This framework helps in quantifying the overall economic performance, distribution of income, and various components of the economy, thereby providing valuable insights for policymakers, economists, and governments.

- National Income Accounting serves as a tool for assessing the economic health of a nation, tracking changes in economic activities over time, and guiding the formulation of economic policies.

- It encompasses various methodologies and approaches to calculate the total value of goods and services produced, income earned, and expenditures made within an economy.

- National Income Accounting is a set of methods and principles used by the government that gives information on how well an economy is performing and where money is created and spent.

- Data on per capita income and growth may be evaluated across time when paired with statistics on the corresponding population.

- The gross domestic product (GDP), gross national product (GNP), and gross national income (GNI) are some of the indicators computed using national income accounting.

- The GDP is a frequently used metric for domestic economic research that reflects the total market value of goods and services produced in a certain country during a given period of time.

- National income accounting systems enable nations to evaluate the consequences of different economic policies as well as the present level of living or income distribution within a population.

What is National Income?

|

National Income Accounting – Key Objectives

- Measuring Economic Performance: It quantifies the total economic output and income generated by an economy, providing a snapshot of its economic performance.

- Monitoring Economic Growth: By analyzing changes in the national income over time, it helps track the growth trajectory of an economy.

- Evaluating Distribution of Income: It assesses how the national income is distributed among various economic agents, such as households, businesses, and the government.

- Informing Policy Formulation: National Income Accounting data informs the formulation of economic policies, fiscal planning, and development strategies.

- Comparing Economies: It allows for international comparisons of economic performance and income distribution among different countries.

- Understanding Economic Structure: It provides insights into the composition of an economy, including the contributions of different sectors like agriculture, industry, and services.

National Income Accounting – Significance

- Although national income accounting is not an exact science, it does give important information about how well an economy is performing and where money is created and spent.

- Data on per capita income and growth may be evaluated across time when paired with statistics on the corresponding population.

- The gross domestic product (GDP), gross national product (GNP), and gross national income (GNI) are some of the indicators computed using national income accounting.

- The GDP is a frequently used metric for domestic economic research, and it reflects the total market value of goods and services produced in a certain country during a given period of time.

Accounting in India

National Income Accounting in India

The National Economic Growth Rate is determined by computing the National Income Accounting, which may be done in a variety of ways:

Income Method

- This technique is concerned with the creation of products and services using capital, land, labour, and other resources.

- Interest, profit, rent, salaries, and other sources of income are all used to create income.

- Mixed-Income, which businessmen and self-employed professionals earn, is another factor to consider.

- Therefore, National Income = Interest + Profit + Rent + Wages + Mixed Income

Example: Calculate the National Income of country X and identify which of the following is not considered while calculating National Income using the Income Method.

- Rent accrued – Rs. 10000

- Salaries – Rs. 20000

- Sale from secondhand goods – Rs. 10000

- Interest earned on Loan – Rs. 20000

Answer: National Income = Interest + Profit + Rent + Wages + Mixed Income

= 10000+20000+20000

= 50000

Here, the sale of second-hand goods will not be counted because it’s not an income generated from land and labour.

Expenditure Method

- This strategy takes into account purchases made by governments, residents, businesses, and other entities. The elements are as follows:

- C = Consumer goods and service expenditures by residents and households

- G = Government expenditures on goods and services

- I = Business Organizations’ Capital Goods and Stocks Expenses

- NX = Net exports, which is defined as exports minus imports.

- As a result, National Income = C+G+I+NX

Value Added Method/ Production Method

- While using the product method, the economy is generally classified into various industrial sectors, such as fishing, agriculture, and transportation.

- The Net Value Added at Factor Cost (NVAFC), which is the value-added at each step, is used to determine National Income.

- We must deduct the following when calculating the same for each industry:

- Net Indirect Taxes

- Capital Consumption

- Raw Material Consumption

- Now NVAFC becomes the value after the deduction of the above things.

- When the NVAFC of industries is summed, the net domestic product at factor cost (NDPFC) is calculated.

- Finally, foreign states’ net income should be included.

- Thus, in India,

- National Income = NDPFC + Net factor income from overseas

National Income Accounting – Advantages

- Economic Assessment: National Income Accounting provides a comprehensive overview of a country’s economic health, allowing policymakers and economists to assess its performance and growth.

- Policy Formulation: It aids in the formulation of effective economic policies, fiscal strategies, and development plans based on accurate data and trends.

- International Comparisons: National Income data allows for meaningful comparisons of economic performance, income distribution, and economic structures across different countries.

- Income Distribution Analysis: It helps in evaluating the distribution of income and wealth among various segments of society, enabling policymakers to address inequality and poverty.

- Resource Allocation: The data guides efficient resource allocation by highlighting sectors contributing significantly to the economy and those needing support.

- Investment Decision: Investors and businesses use national income data to make informed investment decisions by gauging the economic environment and consumer purchasing power.

National Income Accounting – Disadvantages

- Exclusion of Non-Market Activities: Non-market activities, such as household production and unpaid work, are often excluded from calculations, leading to an incomplete representation of economic activities.

- Quality of Data: The accuracy of National Income data depends on the quality of data collection, which might vary across sectors and regions.

- Excessive Focus on Quantification: Relying solely on quantitative measures might overlook qualitative aspects of economic well-being, like environmental sustainability and overall quality of life.

- Limited Scope: National Income Accounting mainly focuses on market-based activities and might not capture the informal sector, informal transactions, and underground economy adequately.

- Changing Economic Landscape: Rapid changes in technology, globalization, and emerging industries can challenge the relevance and accuracy of existing methodologies.

- Complexity of Data Interpretation: Interpreting National Income data requires a nuanced understanding of economic concepts, which might be challenging for the general public.

Conclusion

National income accounting, which is considered an aggregate of a country’s economic activity, thus provides economists and statisticians with specific information that can be used to track an economy’s health and estimate future growth and development.

The data may be used to guide inflation policy, which is especially valuable in changing economies of the developing nation, as well as information on output levels related to moving labour forces.

Mains Questions

Q. Enumerate the significance of National Income Accounting? (150 Words) 10 Marks

Introduction

The different methods of calculating national income are the Income Method, Production (Value-Added) Method, and Expenditure Method. National Income serves as a critical indicator of a country’s economic health and progress.

It quantifies the total value of all goods and services produced within the country’s borders during a specific time period. To accurately measure this economic metric, economists employ various methods, each offering a unique perspective on economic activity.

The topic “Methods of Calculating National Income” is one of the important concepts in the UPSC/IAS 2023 Economy syllabus which is discussed in this article in detail.

How is National Income Calculated?

- After depreciation, the total worth of final products and services generated by normal residents throughout an accounting year is called the national income.

- Goods and services are generally produced by the production units. They do it by utilising four factors of production: land, labour, capital, and entrepreneurship.

- These four factors of production work together to create goods and services, adding value to existing goods.

- This additional value, or net domestic product, is dispersed among the owners of the four components of production, who receive rent, employee compensation, interest, and profit in exchange for their contribution to the production of products and services.

- The profits earned by the owners of the factors of production are used to acquire goods and services from the production units for consumption and investment.

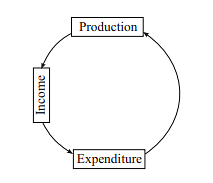

- In a nutshell, manufacturing generates revenue. Income is utilised to fund spending, and spending, in turn, fuels more production.

- The circular flow of national income has three phases: Production, Income and Expenditure.

Methods of Calculating National Income

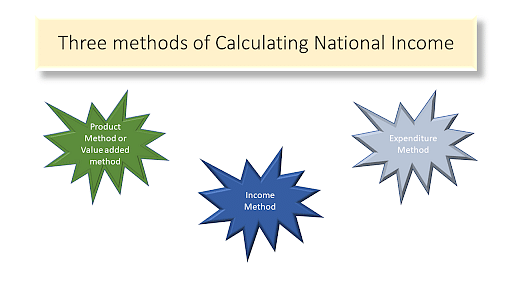

- The three methods of calculating national income are:

- Value Added Method

- Income Method

- Expenditure Method

- To enhance accuracy and comprehensiveness, economists often combine two or more methods to calculate National Income.

- This triangulation helps mitigate the limitations of individual methods and provides a more accurate depiction of an economy’s performance.

What is Value Added Method?

- Value added refers to the difference between the value of a firm’s output and the value of the intermediate goods and services used in the production process.

- It represents the net contribution of a firm or a sector to the economy.

- The method involves breaking down the economy into different sectors such as agriculture, industry, and services.

- For each sector, the value added is calculated by subtracting the value of intermediate consumption (inputs used in production) from the value of output (goods or services produced). This ensures that only the additional value created at each stage is considered.

- One of the primary challenges in calculating National Income is the risk of double counting. Double counting occurs when the value of intermediate goods and services is included multiple times in the calculation process.

- The Value Added Method addresses this challenge by excluding intermediate consumption, focusing only on the value added at each stage.

What is the Income Method?

- The Income Method is one of the key approaches used to calculate a nation’s National Income.

- It focuses on assessing the total income earned by individuals, businesses, and the government within an economy during a specific time period.

- This method provides insights into how the generated income is distributed among different factors of production, such as labor, capital, and land.

- By analyzing various sources of income, the Income Method offers a comprehensive view of the economic activity within a country.

- The method involves aggregating the different sources of income earned by various economic agents, including individuals, households, businesses, and the government.

- These sources of income include wages and salaries, rent, interest, profits, and taxes.

What is the Expenditure Method?

- The Expenditure Method focuses on estimating the total value of expenditures made by various economic agents within an economy during a specific time period, typically a year.

- By analyzing the expenditures made by consumers, businesses, government entities, and net exports (exports minus imports), the Expenditure Method provides insights into the overall economic activity and performance of a country.

- The Expenditure Method is based on the principle that the total expenditure in an economy is equal to the total income generated in that economy.

- It assumes that every transaction that involves spending contributes to the production of goods and services, and thus, to the generation of income.

- To avoid double counting, certain items such as intermediate goods (goods used in the production of other goods) are excluded, while taxes on products and subsidies are included.

Conclusion

Calculating National Income is a complex endeavor that requires a comprehensive approach. By using different methods, economists and policymakers gain a multifaceted understanding of an economy’s dynamics. While each method has its limitations, their combination helps provide a more accurate and holistic picture of economic health.

Introduction

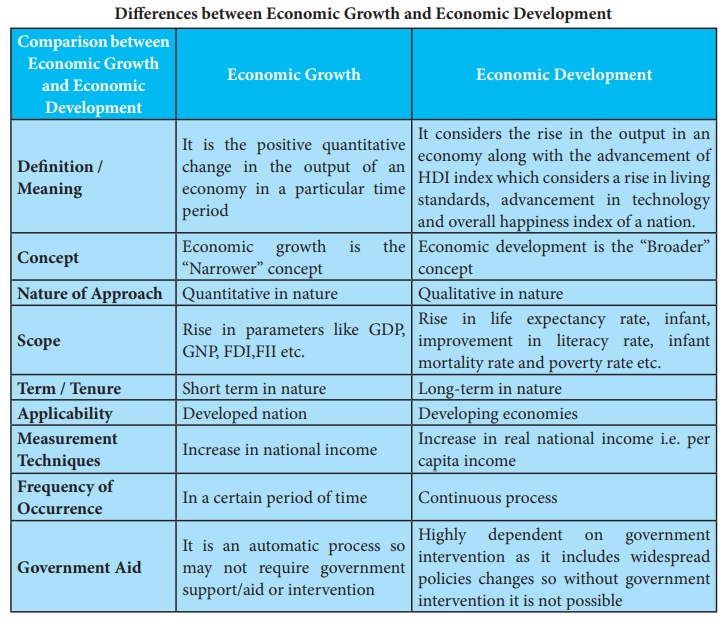

Even though the terms economic development and economic growth sound similar, there is a significant difference between the two. While both economic growth and economic development are important indicators of a country’s economic health, there are important distinctions between the two.

Economic growth is a relatively narrow concept. It entails a quantitative increase in output, whereas economic development includes qualitative changes such as social attitudes and customs, in addition to quantitative growth in output or national income. Economic development is nearly impossible to imagine without growth.

What is Economic Growth?

- Economic growth is defined as an increase in the production of economic goods and services from one period of time to another.

- Economic growth denotes an increase in both national income and per capita income.

- The increase in per capita income is a better measure of Economic Growth because it reflects an improvement in the living standards of the masses.

- Let’s consider that a unique berry only grows naturally in the land of Utopia. This berry has been utilised by natives of Utopia for many years, but a wealthy German traveller recently found it and took samples back to Germany. Because his German acquaintances like the berry, the tourist invested in a major berry exporting company in Utopia. Hundreds of Utopians were engaged by the new berry exporting company to farm, harvest, wash, box, and ship the berries to German supermarkets.

- Because the total value of the goods and services generated by the new berry exporting business exceeded one million dollars in a calendar year, the berry exporting business added over one million dollars to Utopia’s GDP. Utopia’s GDP increased, indicating that the country achieved economic growth.

- Economic growth is defined as an increase in real national income rather than an increase in money income or nominal national income.

- In other words, the increase should be based on an increase in the output of goods and services rather than a simple increase in the market prices of existing goods.

- Real income should rise gradually over time: The rise in real national income and per capita income should be sustained over time.

- Seasonal or temporary income increases should not be confused with economic growth.

- Income growth should be based on increased productive capacity.

- Increases in income can only be sustained if they are the result of a long-term increase in the economy’s productive capacity, such as:

- modernization or the use of new technology in manufacturing, infrastructure strengthening such as transportation networks, improved electricity generation, and so on.

- Capital goods, labour force, technology, and human capital all have the potential to contribute to economic growth.

What is Economic Development?

- Economic development is defined as a sustained improvement in society’s material well-being.

- Few indicators of economic development are qualitative indicators such as the HDI (Human Development Index), gender-related indexes, Human Poverty Index (HPI), infant mortality, literacy rate and so on.

- From the above example of Utopia, before the berry exporting business, most Utopians lived in small settlements spread out over many miles. Only a small percentage of Utopians had access to schools, clean water, or healthcare. To feed their immediate families, utopian men worked long hours attempting to harvest land that was naturally unsuited for most crops.

- After the export of berries and an increase in the government’s revenue, Utopians will get better access to schools, clean water and affordable healthcare. The export industry provides better wages and fixed working hours.

- Utopia’s development indicators such as literacy rate, per capita income and access to healthcare, improve indicating economic development.

- Economic development encompasses a broader range of concepts than economic growth.

- Aside from national income growth, it includes social, cultural, political, and economic changes that contribute to material progress.

- It includes changes in resource supplies, capital formation rates, population size and composition, technology, skills, and efficiency, as well as institutional and organisational structure.

- These changes contribute to the larger goals of ensuring more equitable income distribution, increased employment, and poverty alleviation.

- It is a long chain of interconnected changes in fundamental supply factors and demand structure that leads to an increase in a country’s net national product in the long run.

Economic Growth vs Economic Development

| Basis of Comparison | Economic Growth | Economic Development |

|---|---|---|

| Meaning | Economic growth is defined as an increase in the country’s real output of goods and services. | Economic development entails changes in income, savings, and investment, as well as gradual changes in the country’s socio-economic structure (institutional and technological changes). |

| Factors | Growth is defined as a gradual increase in one of the components of GDP: consumption, government spending, investment, and net exports. | Development related to human capital growth, a reduction in inequality numbers, and structural changes that improve the population’s quality of life. |

| Measurement/ Example | Economic growth is measured quantitatively by factors such as real GDP growth or per capita income growth. | To assess economic development, qualitative indicators such as the HDI (Human Development Index), gender-related indexes, Human Poverty Index (HPI), infant mortality, literacy rate, and so on are used. |

| Effect | Quantitative changes in the economy are brought about by economic growth. | Economic development results in both qualitative and quantitative changes in the economy. |

| Relevance | Economic growth reflects national or per capita income growth. | Economic development reflects progress in a country’s quality of life. |

Why Economic Growth and Economic Development are important?

- Economic growth is a widely used term in economics that is useful not only for national-level economic analyses and policymaking but also for comparative economics.

- International financial and commercial institutions base policymaking and future financial planning on the available growth rate data for the world’s economies.

- The most important aspect of growth is its quantifiability, or the ability to quantify it in absolute terms.

- Just as we need to make conscious efforts to increase our income and growth, we also need to make conscious efforts to increase our economic development and higher economic development.

- Development has not been possible anywhere in the world without a conscious public policy.

- Similarly, we can say that there can be no development without growth.

- If economic growth is used properly for development, it will re-accelerate growth and eventually bring a larger population into the development arena.

- Similarly, high growth with low development leads to a decline in growth.

Conclusion

Economic development is a subset of economic growth. Economic development encompasses a broader scope than economic growth.

Economic development employs a variety of indicators to assess the state of an economy as a whole; however, economic growth employs only a few indicators for calculation, such as gross domestic product, individual income, and so on.

It should be noted that economic growth is necessary but not the only condition for economic development.

Introduction

Economic growth is the change – increase or decrease in the value of goods and services produced by an economy. It needs to be measured as government and private sector decisions and policies need a base for their actions. All important aspects of the economy are linked to growth: tax collections, interest rates; inflation and its expectations; employment; foreign trade and so on.

Without measuring growth, there is no rationality in behaviour – both public and private. Investment decisions depend on the growth and inflation rate, to give one example. That is the reason for the Central Statistics Office (CSO) (now National Statistical Office) of India to project growth figures weeks before the Union Budget is presented facilitating rational projection of revenues and expenditure which in turn influences the private sector decisions.

Factors Affecting the Economic Growth

Economic growth is a highly complex phenomenon that is influenced by a wide range of factors, including political, social, and cultural factors. These elements are as follows:

Economic Factors

Natural Resources

- Natural resources are the most important factor influencing an economy’s development.

- Natural resources include land area and soil quality, forest wealth, a good river system, minerals and oil resources, a favourable climate, and so on.

- The abundance of natural resources is critical for economic growth.

- A country lacking in natural resources may be unable to develop rapidly.

Capital Formation

- Capital formation is the process by which a community’s savings are channelled into investments in capital goods such as plants, equipment, and machinery, which increases a country’s productive capacity and worker efficiency, ensuring a greater flow of goods and services in a country.

Technological Progress

- Technological progress primarily entails research into the use of new and improved methods of production or the improvement of existing methods.

- Natural resources are sometimes made available as a result of technological progress. However, in general, technological progress leads to increased productivity.

Entrepreneurship

- Entrepreneurship entails the ability to identify new investment opportunities, as well as the willingness to take risks and invest in new and growing business units.

Human Resources Development

- A good quality of population is critical in determining the level of economic growth.

- As a result, investment in human capital in the form of educational, medical, and other social schemes is highly desirable.

Population Growth

- The increase in labour supply is a result of population growth, which creates a larger market for goods and services. As a result, more labour produces more output, which a larger market absorbs.

- Output, income, and employment continue to rise as a result of this process, and economic growth improves.

Social Overheads

- The provision of social overheads such as schools, colleges, technical institutions, medical colleges, hospitals, and public health facilities is another important determinant of economic growth.

- Such facilities help the working population to be healthier, more efficient, and more responsible.

Non-Economic Factors

Political Factors

- Political stability and strong administration are critical to modern economic growth.

- A stable, strong, and efficient government, honest administration, transparent policies, and their efficient implementation foster investor confidence and attract domestic and foreign capital, resulting in faster economic development.

Social and Psychological Factors

- Social factors include social attitudes, social values, and social institutions, which change as education expands and cultures shift from one society to the next.

- Modern ideology, values, and attitudes result in new discoveries and innovations, as well as the rise of new entrepreneurs.

Education

- It is now widely acknowledged that education is the primary means of development.

- Greater progress has been made in countries where education is widely available.

Desire for Material Betterment

- The desire for material advancement is a necessary prerequisite for economic development.

- Societies that place focus on self-satisfaction, self-denial, and faith in fate, limit risk and enterprise, causing the economy to stagnate.

Measures Taken to Ensure Economic Growth

- Economic growth can be achieved when the rate of increase in total output exceeds the rate of increase in a country’s population.

- A country’s human resources should be sufficient in number and equipped with the necessary skills and abilities in order to achieve economic growth.

- The efficient utilisation or exploitation of natural resources is dependent on human resource skills and abilities, the technology used, and the availability of funds. A country with a skilled and educated workforce and abundant natural resources propel its economy forward.

- Capital formation increases the availability of capital per worker, which raises the capital/labour ratio even further. As a result, labour productivity rises, leading to an increase in output and economic growth.

- Technological advancement aids in increasing productivity with limited resources. Countries that have worked in the field of technological development grow faster than countries that have placed less emphasis on technological development.

- Social and political factors play an important role in a country’s economic growth. Social factors include customs, traditions, values, and beliefs, all of which contribute significantly to an economy’s growth.

- A society with traditional beliefs and superstitions, for example, is resistant to adopting modern ways of life. Achieving becomes difficult in such a situation.

- Aside from that, political factors such as government participation in policy formulation and implementation play a significant role in economic growth.

Conclusion

Sustained economic growth in a country has a positive impact on national income and employment levels, resulting in higher living standards.

Aside from that, it plays an important role in stimulating government finances by increasing tax revenues. Economic growth in a country is possible if the economy’s strengths and weaknesses are properly assessed.

Mains Questions

Q. Discuss the factors affecting the Economic Growth? (150 Words) 10 Marks

Introduction

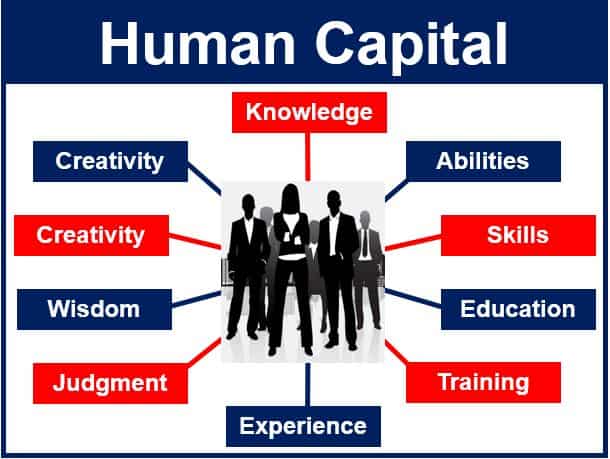

The monetary value of a person’s knowledge, skills, and competencies is referred to as human capital. To determine an individual’s human capital, add up his current wages and what he is projected to earn in the future.

What is Human Capital?

- The economic value of a worker’s experience and skills is referred to as human capital. Education, training, intelligence, skills, health, and other qualities valued by employers, such as loyalty and punctuality, are all examples of human capital.

- As a result, it is an intangible asset or characteristic that does not (and cannot) appear on a company’s balance sheet.

- Human capital is thought to boost productivity and consequently profits.

- The more a firm invests in its personnel, the better its prospects of productivity and success increase.

Understanding Human Capital

- From the top down, an organisation is only as good as its people, which is why human capital is so important to a firm.

- Workforce planning and strategy, recruitment, employee training and development, and reporting and analytics are among the key directives.

- Human capital acknowledges that not all work is created equal. Employers, on the other hand, can improve the quality of that capital by investing in their workers.

- Employees’ education, experience, and abilities can be used to accomplish this. All of this has a significant economic impact on employers and the whole economy.

- These investments in human capital can be easily calculated because they are based on the investment of employee skills and knowledge through education.

- Any human capital return on investment (ROI) can be computed by dividing the company’s total profits by its entire human capital investments.

- For example, if Company Xyz invests $1 million into its human capital and has a total profit of $10 million, managers can compare the ROI of its human capital year-over-year (YOY) in order to track how profit is improving and whether it has a relationship to the human capital investments.

Human Capital and Economic Growth

- Human capital has a strong relationship with economic growth, which is why it can help boost the economy.

- This is due to the fact that people have a wide range of abilities and information. This relationship can be assessed by how much money is invested in people’s education.

- Some governments realise the link between human capital and the economy, and as a result, they provide free or low-cost higher education.

- People with a greater level of education are more likely to earn better salaries, allowing them to spend more.

Does Human Capital Depreciate?

- Human capital, like anything else, is subject to depreciation. Wages or the capacity to stay in the workforce are frequently used as indicators.

- Unemployment, injury, mental deterioration, and the inability to keep up with innovation are the most typical ways human capital depreciates.

- Consider an employee with a unique skill set. They may not be able to maintain these levels of specialisation if they are unemployed for a long time. That’s because, once they reenter the workforce, their talents may no longer be in demand.

History of Human Capital

- Human capital is a concept that dates back to the 18th century. The concept was introduced by Adam Smith in his book ‘An Inquiry into the Nature and Causes of the Wealth of Nations’, which examined a nation’s wealth, knowledge, training, abilities, and experiences.

- Adams proposed that increasing human capital through training and education results in a more profitable firm, which contributes to society’s overall prosperity. That, according to Smith, makes it a win-win situation for everyone.

- The term was most recently used to denote the labour necessary to manufacture manufactured goods.

- But the most modern theory was used by several different economists including Gary Becker and Theodore Schultz, who invented the term in the 1960s to reflect the value of human capacities

- Schultz felt that human capital, like any other type of capital, could be used to improve the quality and quantity of output. This would necessitate an investment in an organization’s employees’ education, training, and better benefits.

- But not all economists agree. Human capital, according to Harvard economist Richard Freeman, was an indicator of talent and competence.

- He believes that in order for a company to truly become productive, it must teach and inspire its personnel as well as invest in capital equipment.

- He came to the conclusion that human capital was not a component in production.

Criticism of Human Capital Theories

- Many people who work in the field of education and training have criticised the human capital idea.

- The theory was criticised in the 1960s primarily for legitimising bourgeois individualism, which was seen as greedy and exploitative.

- The bourgeoisie was made up of persons from the middle class who were seen to exploit the working class.

- The notion was also thought to hold people responsible for any systemic flaws and to turn employees become capitalists.

What Are Examples of Human Capital?

Communication skills, education, technical abilities, creativity, experience, problem-solving skills, mental health, and personal resilience are all examples of human capital.

Relationship Between Human Capital and the Economy

- Human capital enables a country’s economy to expand.

- Gains in human capital in fields like science, education, and management lead to increases in innovation, social well-being, equality, productivity, and participation rates, all of which contribute to economic growth.

- Increases in economic growth tend to increase a population’s quality of life.

What is Human Capital Risk?

- The gap between a company’s or organization’s human capital requirements and its workforce’s existing human capital is referred to as human capital risk.

- This chasm can lead to inefficiency, failure to meet goals, a tarnished reputation, fraud, financial loss, and eventual liquidation of an organization.

- An organisation should teach, foster, and support its personnel to mitigate and eliminate human capital risk.

Conclusion

- Human capital is an intangible asset that is not recorded on the financial sheet of a corporation.

- The term “human capital” refers to qualities such as an employee’s experience and skills.

- Because not all labour is created equal, firms can develop human capital by investing in their employees’ training, education, and perks.

- Economic growth, productivity, and profitability are all seen to be linked to human capital.

- Human capital, like any other asset, can depreciate due to long periods of unemployment and a failure to stay up with technology and innovation.

Introduction

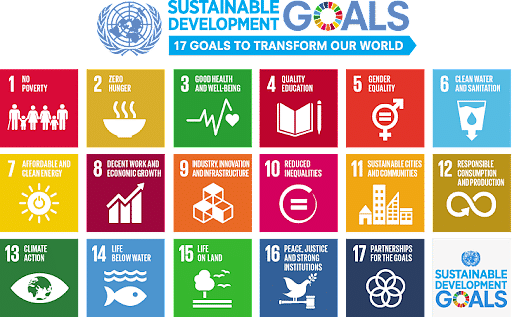

Sustainable development is a multidimensional concept that emphasizes achieving economic progress, social equity, and environmental protection while ensuring that the needs of the present generation are met without compromising the ability of future generations to meet their own needs. It recognizes the interdependence between economic growth, social well-being, and environmental sustainability.

When it comes to production, using recycled materials or renewable resources is an example of sustainable development.

What exactly is Sustainable Development?

- Sustainable development is an approach that aims to achieve human development objectives while allowing natural systems to support human needs for essential ecosystem services and natural resources.

- Sustainable development was first defined in the Brundtland Commission in its report Our Common Future in the year 1987.

- Sustainable development (SD) includes a concerted effort to create a future for people and the planet that is inclusive, sustainable, and resilient.

- Sustainable development aims to strike a balance between economic, social, and environmental aspects to ensure a harmonious and equitable future for all.

- It emphasizes long-term thinking, responsible resource management, and inclusive growth.

- Sustainable development is not just about economic growth; it’s a broader concept that takes into account the long-term well-being of people and the planet.

- It necessitates responsible decision-making that considers economic, social, and environmental implications.